accumulated earnings tax irs

BJ Haynes Tax Lawyer Former IRS Special Agent Can Help. The accumulated earnings credit allowable under section 535 c 1 on the basis of the reasonable needs of the business is determined to be only 20000.

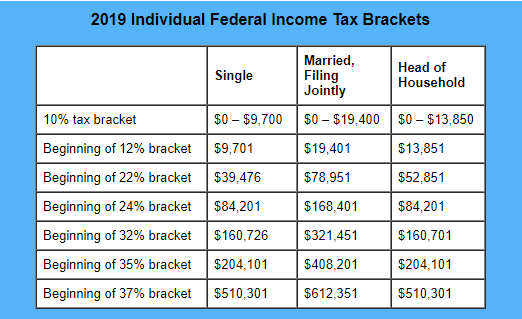

Low Tax Rates Provide Opportunity To Cash Out With Dividends

If youve never heard of this tax youre not alone.

. Exemption levels in the amounts of 250000 and 150000 depending on the company exist. Add the result to the total tax liability before the refundable credits on your income tax return for the year of the accumulation distribution. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being.

However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to. Keep in mind that this is not a self-imposed tax. 1120 or Schedule M-3 Form 1120 for the tax year also attach a schedule of the differences between the earnings and profits computation and the Schedule M-1 or Schedule M-3.

A corporation determines this amount by adjusting its taxable income for economic items to better reflect how much cash it has available to make dividend distributions. The purpose of accumulated earning tax is to discourage the accumulation of profits if the purpose of such accumulation is to enable shareholders to avoid paying taxes on those profits by not paying them dividends. Publicly held corporations with many.

The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

Accumulated Earnings Tax. However since the amount by which 150000 exceeds the accumulated earnings and profits at the close of the preceding taxable year is more than 20000 the minimum accumulated earnings. There is a certain level in which the number of earnings of C.

A year-by-year computation of the accumulated earnings and profits and a schedule of differences since the origin of the. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

The purpose of the tax. This is a pretty obscure tax but it does carry a hefty penalty if you arent following the rules. Code 531 - Imposition of accumulated earnings tax.

If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the business the corporation may be assessed tax penalty called the accumulated earnings tax IRC section 531 equal to 20 percent 15 prior. The purpose of the accumulated earnings tax is to compel. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business purpose then IRC 532 provides an accumulated earnings tax that can be assessed on accumulated earnings with no clear business purpose. Dont Face The IRS Alone. Additionally the IRS will forgo the tax penalty on accumulated income if the company provides a statement and plan showing that the capital accumulation is being done for a.

The tax is assessed at the highest individual tax rate on the corporations accumulated income and is in addition to the regular corporate income tax. In addition to other taxes imposed by this chapter there is hereby imposed for each taxable year on the accumulated taxable income as defined in section 535 of each corporation described in section 532 an accumulated earnings tax equal to 20 percent of the accumulated taxable income. The point of this tax is to encourage companies to issue dividends to their shareholders rather than sit on the earnings which ironically often leads to the shareholders paying taxes on the dividend.

The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a much higher scheduled rate of 396. An IRS review of a business can impose it. The accumulated earnings tax can be a hidden penalty tax on highly profitable corporations that allow their earnings to accumulate without paying adequate or any dividends to their shareholders.

In light of recent IRS enforcement efforts corporations should take action to defend against the potential imposition of the accumulated earnings tax. Attach this form to that return. It will increase the accumulated depreciation on balance and depreciation expense on PL.

Additional deduction will reduce the net profit that brings you back to the balance sheet. The IRS is reporting an uptick in accumulated earnings tax audits of C Corporations. Ad BBB Accredited A Rating.

The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. As a practical matter the tax is col-. So your asset goes down because of your accumulated depreciation and your equity goes down because of the net profit.

The base for the accumulated earnings penalty is accumulated taxable income. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. Ad Contact Haynes Tax Law Now.

What is the Accumulated Earnings Tax. The tax is assessed by the IRS rather than self-assessed. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its shareholders by permitting earnings and profits to accumulate instead of being divided or distributed.

531 and 532. Write From Form 4970 and the amount of the tax to the left of the line 8 entry space. End Your IRS Tax Problems - Free Consult.

Depending on what you have on your balance sheet. He accumulated earnings tax AET is imposed by Internal Revenue Code IRC section 531 on C corporations formed or availed of for the purpose of avoiding the imposi-tion of income tax on their shareholders by permitting earnings and profits to be accumulated instead of being distrib-uted. Its not commonly understood even though the penalties can be pretty steep.

Keep in mind that this is not a self-imposed tax.

Earnings And Profits Computation Case Study

Cares Act Implications On Corporate Earnings And Profits E P

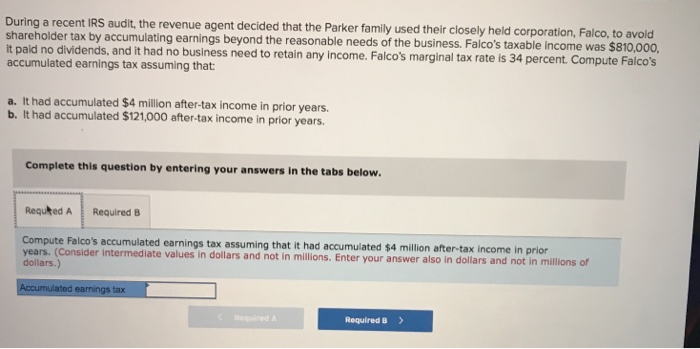

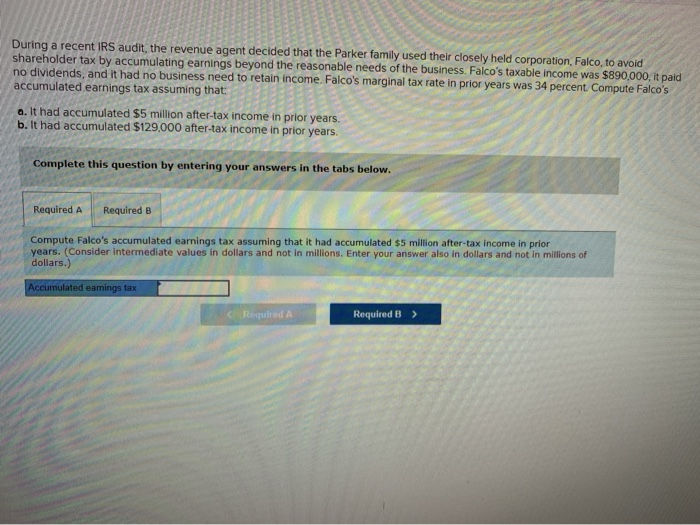

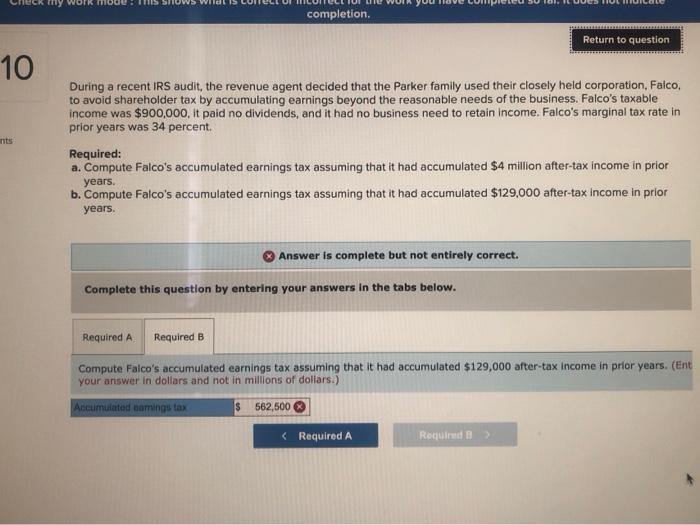

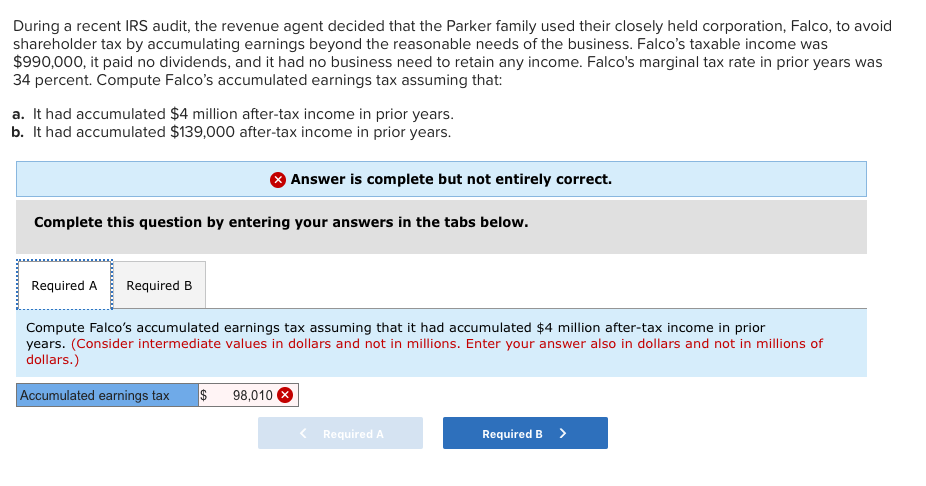

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

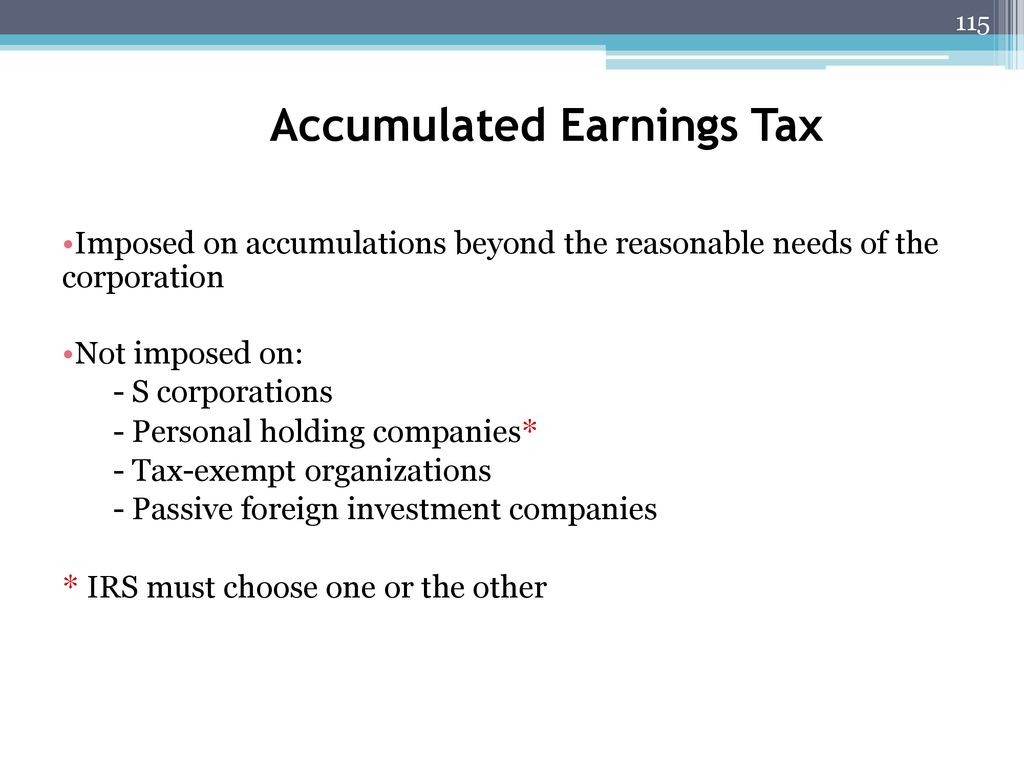

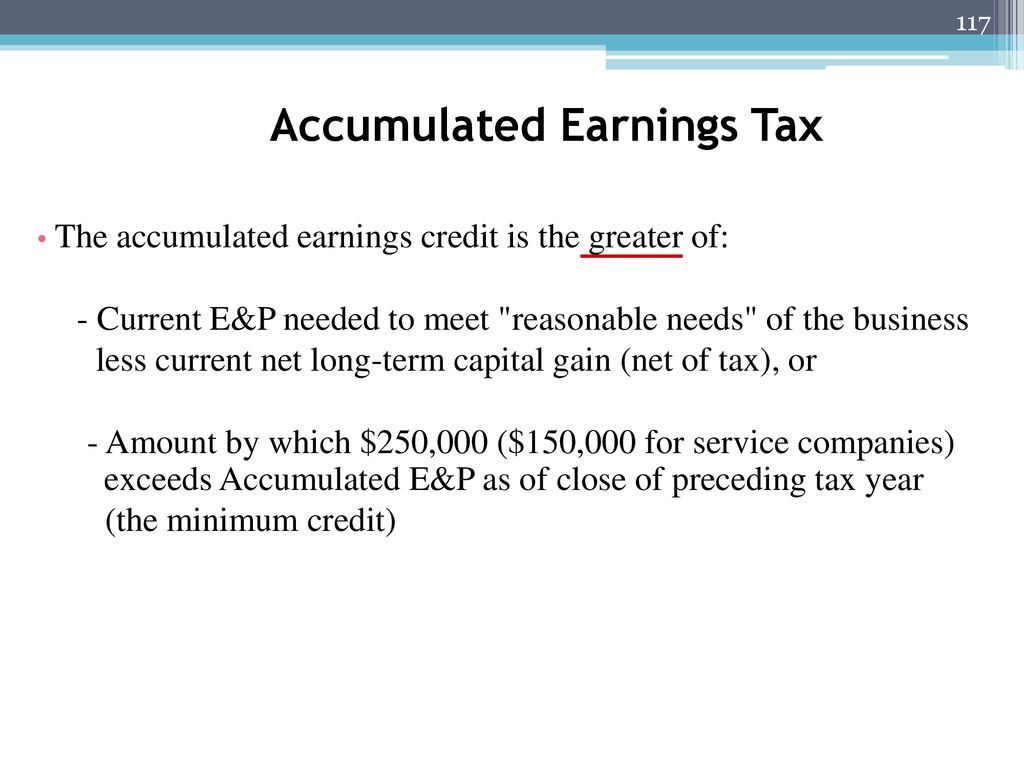

Corporate Tax Copyright Ppt Download

Solved Determine Whether The Following Statements About The Chegg Com

Simple Strategies For Avoiding Accumulated Earnings Tax Tax Professionals Member Article By Mytaxdog

What Are Accumulated Retained Earnings

Earnings And Profits Computation Case Study

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Earnings And Profits Computation Case Study

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

Demystifying Irc Section 965 Math The Cpa Journal

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Solved Completion Return To Question 10 During A Recent Irs Chegg Com

Corporate Tax Copyright Ppt Download

Irs Use Of Accumulated Earnings Tax May Increase

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com